Tenant Credit Check

Pull a clear and human readable credit report.

Table of Contents

Guessing is not an option, when it comes to finding reliable tenants. A Rental Credit History Check gives landlords and property managers a clear picture of a future tenant’s financial situation and responsibility. It helps them to answer to an important question, which is “Will they pay rent be paid on time?”

Unlike a standard credit report, a Rental Credit History Check focuses on rental-relevant financial behavior. It provides detailed information about payment history, debts, public records, and past rental issues (e.g. evictions). This information helps landlords and property managers make informed decisions and avoid future risks.

Let’s look into what a tenant credit check is and how it can help you.

What Is a Rental Credit History Check?

A rental credit history check is tenant screening that landlords and property managers use to evaluate how financially reliable their tenant is. Unlike credit scores, this report provides detailed information about tenant’s financial behavior. This detailed information includes their payment history such as late bill payments and debts history.

At its core, the rental credit history check answers one key question: “Can I trust this person? Will the rent pay be paid consistently and on time?”

Unlike standard consumer credit report, a rental credit history check highlights factors that relevant to housing decisions, such as:

- Payment history – how reliably and consistently a tenant has been paying past obligations.

- Debts and credit utilization – whether their current financial load leaves room for regular rent payments.

- Public records – bankruptcies and judgments

- Rental-specific history – evictions.

Typically, landlords, property managers, and real estate agents pull out these reports as part of the rental application process. Tenants must give written consent before a you run credit history check.

In short, a rental credit history check is your future tenant’s resume.

Key Information Shown in a Rental Credit Report

When reviewing a tenant’s credit report, you aren’t just looking at a single number. A rental credit history check provides information about your future tenant’s financial and rental behaviors. Each rental credit history check platform suggests its own report and includes the information that they find the most relevant. Thus, the length, readability and information may vary across the platforms. Here are the main details that the platforms typically in their rental credit history report:

Personal Information

Usually, this is tenant’s full name, date of birth, current and previous addresses, and social security number. To Ensure that the applicant is who they say they are and that the credit data matches the correct person it is crucial to have the right information before starting credit history check.

Credit Score

Credit score is usually a quick indicator of financial reliability. Usually, it is presented in the form of a chart that varies from as low as 300 to the highest 900. Higher scores suggest strong credit management, while lower scores can signal late payments, high debt, or past financial difficulties.

Payment History

This is a record of how consistently the tenant has been paying the bills, such as credit cards, loans, or utilities. You can interpret that on time payments demonstrate responsibility, while late or missed payments are red flags for potential rent delays.

Current Debts and Credit Utilization

A rental credit report indicates tenant’s credit card balance. It can include student loans, auto loans, and other financial obligations. Here, on time payments is a positive sign and is an indicator of responsibility and financial stability

On the other hand, a high debt load can raise concerns, as it means that your tenants are unstable financially. They may find it difficult to keep up with paying rent on time, since a large portion of their income is already committed elsewhere.

Public Records and Negative Marks

A rental credit history check report may also include information about serious financial problems, such as bankruptcies, tax lines, court judgments, or accounts that have been sent to collections. This is a serious negative signal that goes beyond late payments. For you this is a warning that your future tenants have even deeper financial instability, and eventually this may affect their ability to keep up with future rent obligations.

Rental and Eviction History

A lot of tenant screening reports also include rental-specific history, such as eviction filings, past lease violations, or unpaid rent-related judgments. These issues usually play a significant role in a landlord’s decision-making process, because they are directly connected with tenant’s ability to maintain housing. In fact, even a single eviction record can cause serious concerns and may outweigh other positive credit indicators.

Employment and Income Verification

Some rental credit reports also include verification of a tenant’s job status and տհեիռ income level. This is important information as it helps you confirm that the applicant has a stable source of earnings. Verifying employment and income becomes an extra layer of assurance for you. This will help you ensure that the tenant can easily meet ongoing lease obligations.

Criminal Background

Depending on the platform that you have chosen to pull your tenant credit history check report from and local regulations, a tenant’s criminal history may also appear in the report. While this information is handled carefully to comply with the law, it is often reviewed in combination with eviction records and income verification. This will give you a complete picture of the applicant’s background.

What Landlords Look for in a Tenant’s Credit Report

Depending on the platform that you have chosen, you can get different information. When you review a rental credit history report, you don’t need to analyze every line of financial data. Instead, you can focus on the sections that reveal whether an applicant is likely to pay rent on time.

Here are the most important areas you need to pay attention to:

Payment History

This is the first and the most important area for you as a landlord. It shows whether a tenant pays bills on time or if there is a pattern of late or missed payments.

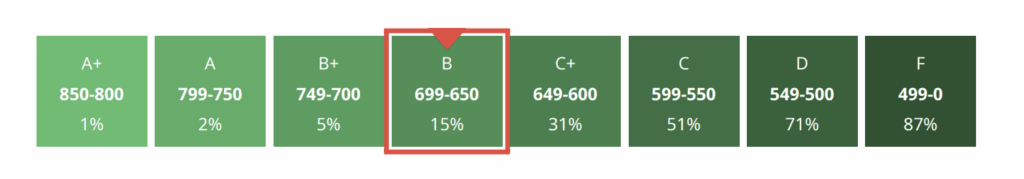

Credit Score

The credit score offers a quick glance at the applicant’s financial health. Every landlord has their unique requirements, many of them consider a score of 620 or higher acceptable. However, there are also landlords who often expect a score 700 or above. The score isn’t everything, but it is usually the first number that you see when you screen tenants.

Debt Levels and Credit Utilization

Landlords also consider how much existing debt a tenant has. Sometimes even tenants with good credit scores can struggle to afford rent if they have a lot of debts. This part of the report shows whether the tenant is financially able to take on additional monthly obligations.

Eviction and Rental History

One of the most telling parts of a rental credit history check is the record of evictions and rental-related judgments. Even a single eviction can be a red flag in a good financial profile. In other words, it clearly reflects how a tenant has handled housing responsibilities in the past.

Public Records

Finally, landlords look at public records to find out about major financial issues (if there are any) such as bankruptcies, or collections.

Tenant Credit Check

Pull a clear and human readable credit report.

Good vs. Bad Rental Credit Reports [with sample]

As mentioned above not all rental credit reports say the same. Some landlords get a heavy, complicated report that is filled with terminology and chart, and are very hard to decode and understand. Others get a simple, comprehensible report that is clear to read and easy to understand. Yet it does not compromise on the information and includes the most important sections and presents all the important sections.

Let’s look into tenant credit check report by tenant credit check tool royalinvest.ca.

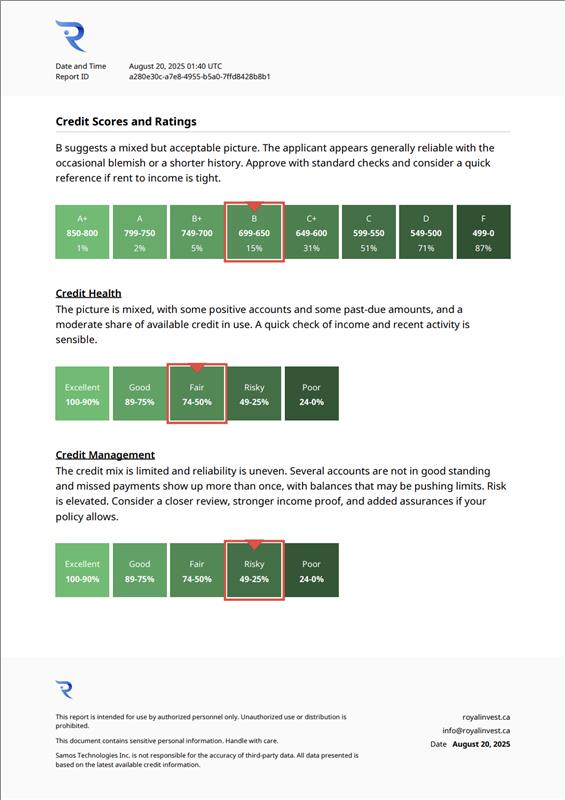

The first thing that you see in our tenant credit check report is your future tenant’s personal information and pass/fail recommendation.

Pass/fail recommendations are your quick and clear hint about whether the applicant has a high or low score. Here pass is high score, whereas fail is low score.

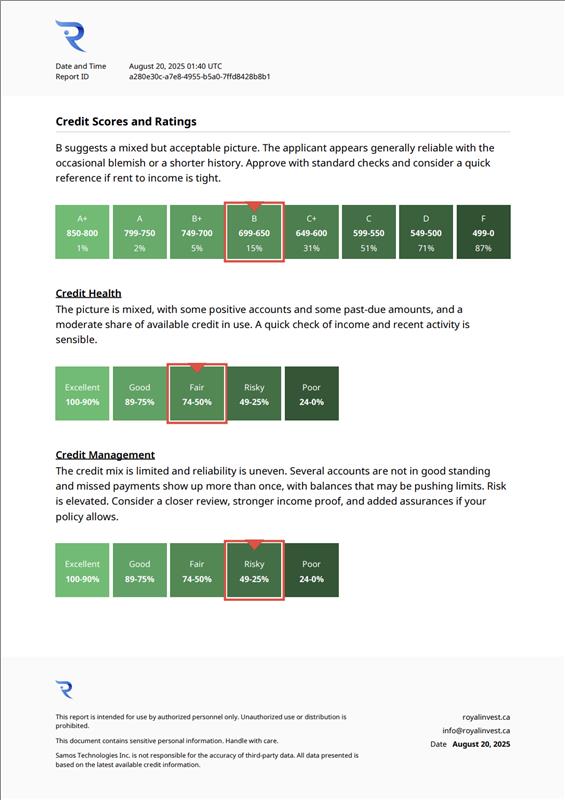

Credit Score and Ratings

A tenant’s credit score and ratings give short and concise information about your future tenant’s overall financial health. While the rental credit history check provides detailed information, the section is an overview of how your future tenant manages debt and pays bills. Royalinvest.ca uses assessment levels where A+ is a good responsibility level and F is a poor one.

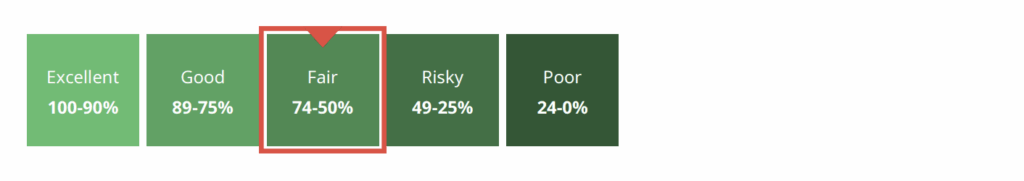

Credit Health

Credit health is the overall picture of a tenant’s financial stability and responsibility.

It includes not only a single credit score, but also combines financial habits, and shows how well an applicant manages money over time. We implement excellent to poor assessment strategy to clearly report the necessary information.

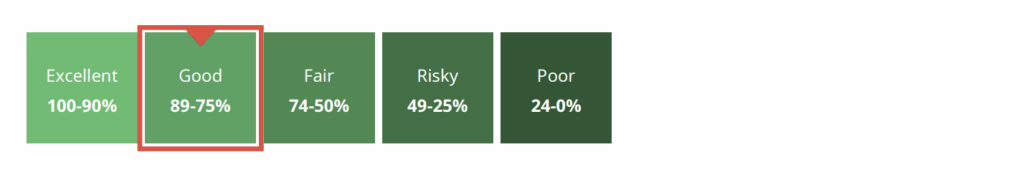

Credit Management

Credit management shows how well a tenant plans, uses, and repays credit over time.

It shows not only their ability to borrow, but also their discipline in keeping balance. As a landlord this information is important for you as you understand how reliable your future tenant will be in a long run.

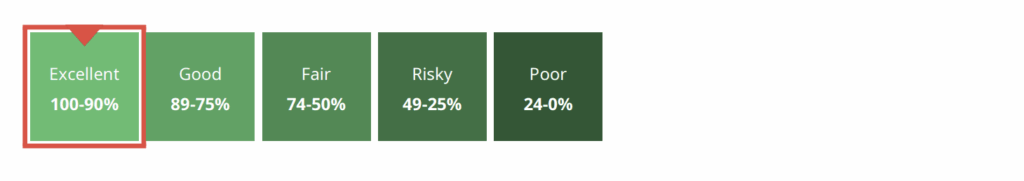

Credit Experience

Credit experience describes how long and how well a tenant has managed credit accounts throughout their financial life. It shows you if your future tenant has a stable record credit experience.

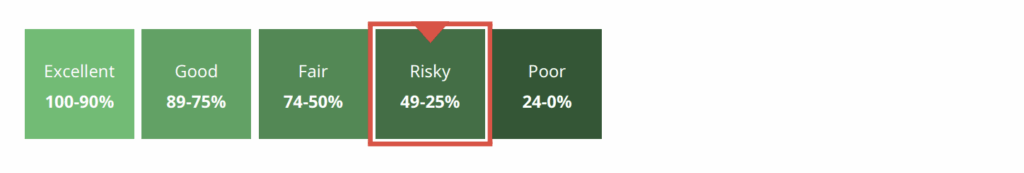

Payment Consistency

Payment consistency reflects how your future tenant meets financial obligations. It is one of the most important indicators that shows if the rent will be paid on time. On the other hand, missed or late payments signal potential risk. This is especially true if paying late is a constant behavior.

Inquiry Volume

Inquiry volume refers to the number of recent credit checks that your future tenant has had over a certain period. A high volume shows that your future tenant is actively looking for new credit. For this case too, a few inquiries are normal. A couple of recent requests for credit warn you that you need to closely examine your future tenant’s financial situation.

When it comes to renting out your property, guessing can be costly. A rental credit history check gives landlords and property managers reliable insights into a tenant’s financial stability, past rental behavior, and overall responsibility. Unlike a standard credit report, it focuses on housing-related risks, such as late payments, high debt, or eviction records, helping you make smarter, safer decisions.

With Tenant Credit Check by royalInvest.ca tool, you get a clear, easy-to-read report with pass/fail recommendations, credit health ratings, and payment consistency indicators. This allows you to quickly evaluate applicants, reduce risks, and ensure that your rent will be paid on time.

Start screening tenants with RoyalInvest.ca today and secure reliable, responsible renters for your property.

What is a rental credit history check?

A rental credit history check (aka tenant screening or tenant credit check) is a detailed report that landlords use to evaluate a tenant’s financial reliability.

Why is a rental credit history check important for landlords?

It helps landlords predict whether a tenant can pay rent consistently or not. It reduces the risk of late payments, lease violations, or costly evictions.

How does a rental credit report differ from a standard credit report?

Unlike a general consumer credit report, a tenant credit check report focuses on housing-relevant information.

Do landlords need tenant consent to run a credit history check?

Yes. Landlords must obtain written consent from their future tenants before pulling a tenant credit report.

Leave a Reply